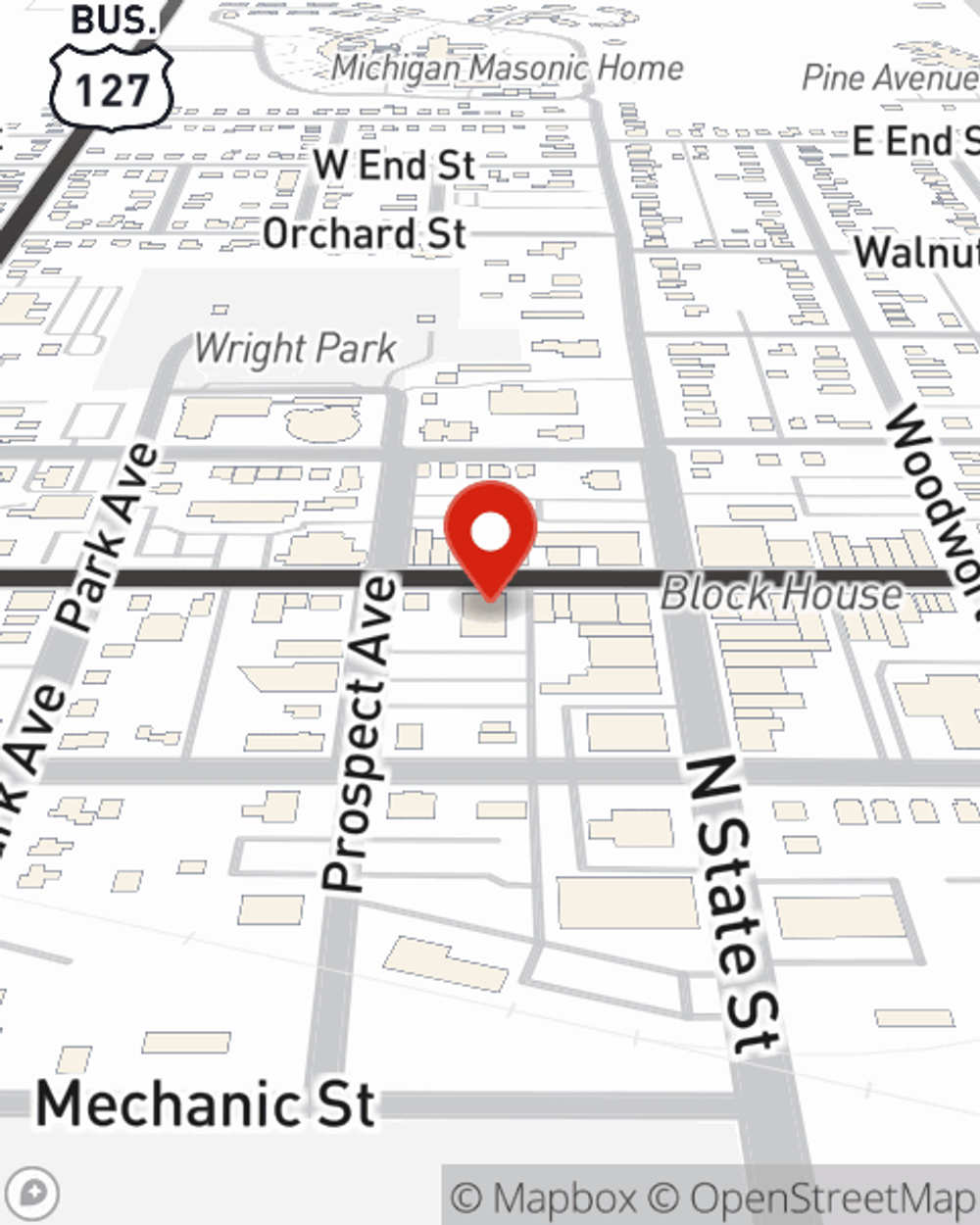

Business Insurance in and around Alma

Looking for small business insurance coverage?

Insure your business, intentionally

- Alma

- St Louis

- Ithaca

- Vestaburg

- Sumner

- Mount Pleasant

- Riverdale

- Sheridan

- Shepherd

- Stanton

- Ashley

- Midland

- St Johns

- Wheeler

- Jackson

- Edmore

- Elwell

- Lansing

- Dewitt

- Clare

- St Charles

- Big Rapids

- Greenville

- Charlotte

Cost Effective Insurance For Your Business.

As a small business owner, you understand that the unexpected happens. Unfortunately, sometimes catastrophes like a staff member getting hurt can happen on your business's property.

Looking for small business insurance coverage?

Insure your business, intentionally

Customizable Coverage For Your Business

With State Farm small business insurance, you can give yourself more protection! State Farm agent Katie Tobias is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If the unexpected happens, Katie Tobias can help you file your claim. Keep your business protected and growing strong with State Farm!

Take the next step of preparation and reach out to State Farm agent Katie Tobias's team. They're happy to help you investigate the options that may be right for you and your small business!

Simple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Katie Tobias

State Farm® Insurance AgentSimple Insights®

Ways to help set financial goals

Ways to help set financial goals

As a business owner, your financial goals should be split into two worlds: one set for your business and another for your personal life.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.